JHVEPhoto/iStock Editorial via Getty Images

JHVEPhoto/iStock Editorial via Getty Images

At a price to Book value of 2.8x and P/E of 15.1x, Cognizant Technology Solutions Corporation (NASDAQ:CTSH) stock trades at a discount relative to the sector. Further, with the change in leadership, there is a reset in Cognizant’s strategy, which can help the company reduce its attrition, win large transformational deals, and improve margins by moving incremental work to offshore locations like India. Cognizant has positioned itself as a leader in digital transformation services, a growing market as companies seek to modernize their technology infrastructure and processes. The company has made significant investments, including strategic acquisitions in cloud computing, IoT, artificial intelligence, and automation, in the last few years to position itself as a strategic partner to its clients. Thus, at the current price, Cognizant looks attractive, and for investors who do not have Cognizant in their portfolio, it is the best time to add the shares to their portfolio.

Cognizant Technology Solutions Corporation, founded in 1994 and headquartered in Teaneck, New Jersey, is a professional services company that provides consulting, technology, and outsourcing services in North America, Europe, and internationally. It operates on a business model by providing digital, technology, consulting, and operations services to clients in various industries through a global delivery model, leveraging technology and automation to increase efficiency and productivity.

In addition, the company offers a wide range of engagement models that focuses on providing customized services and solutions to its clients based on their specific needs and requirements. Some of its engagement models include Project-based engagement, Managed Services model, Consulting services, Co-creation and outcome-based engagements. In Project-based engagement, the company works with its clients to deliver specific projects with a clearly defined scope, timeline, and budget. In the Managed Services model, Cognizant provides ongoing support and maintenance for clients’ IT systems and infrastructure, focusing on achieving specific outcomes and service levels. In the Consulting engagements, the company provides strategic advice and guidance to clients, helping them to identify and address business challenges and opportunities. In the Co-creation engagements, Cognizant collaborates with clients to develop innovative solutions and products, leveraging the company’s digital capabilities and industry expertise. In Outcome-based engagements, the company partners with clients to achieve specific business outcomes, with payment tied to achieving those outcomes.

Cognizant has different pricing models catering to the above engagements. For example, some pricing models include Time and Materials, where the company charges clients based on the time and materials used to complete a project or engagement, including labour, materials, and expenses; fixed price, where the company charges a fixed price for a specific scope of work or project, with payments typically tied to milestones or deliverables, Outcome-based Pricing, where the company ties its pricing to the achievement of specific outcomes or business results, with payments made based on the achievement of those outcomes, Managed Services Pricing where the company charges a recurring fee for ongoing support and maintenance services, typically based on a defined set of services and service levels and Shared Risk/Reward Pricing where Cognizant shares the risk and reward of an engagement with the client, with pricing tied to the achievement of mutually agreed-upon business goals.

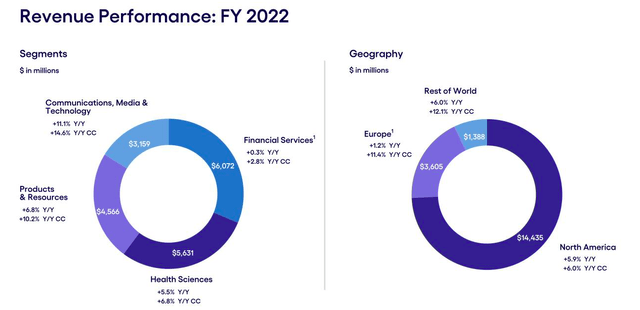

Cognizant Investor Relations

Cognizant Investor Relations

The company operates in four industry segments – Financial Services, Health Sciences, Products & Resources and Communications, and Media & Technology. Financial services have traditionally been the company’s strongest vertical and contribute 31% of its revenues, followed by Healthcare (29%), Products (24%) and Communications, Media & Technology (16%). Further, the company gets 74% of its revenues from the US, followed by 19% in Europe and 7% from the Rest of the World. In 2022, the company completed the sale of the Samlink subsidiary, reporting a lower growth in its financial services segment than last year.

Author Calculations

Author Calculations

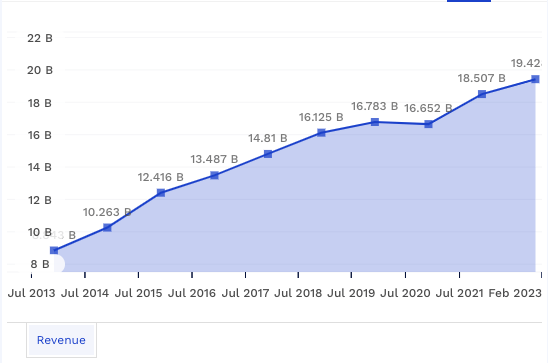

In the last ten years, Cognizant grew to 8.2% CAGR, but in the last five years, the company has lagged behind its competitors, growing at 3.8% CAGR due to its inability to win large multi-million contracts from its customers. As a result, Cognizant has ceded market share to Infosys.

Author Calculations

Author Calculations

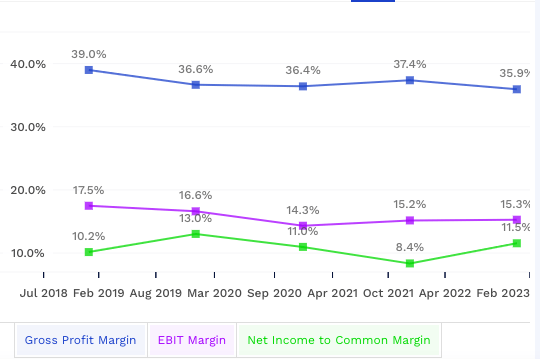

The company’s gross margin and operating margin have also declined in the last five years due to higher attrition, higher cost structure and restructuring initiatives which resulted in higher severance payments.

Author Calculations

Author Calculations

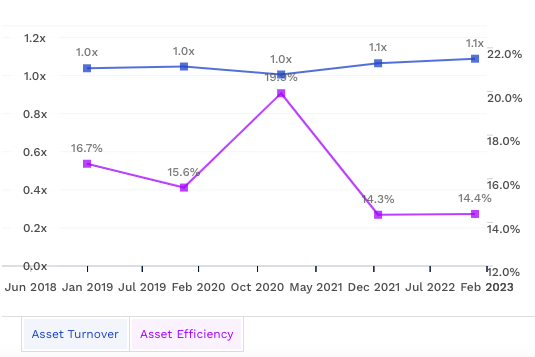

The company’s asset turnover improved in the last five years. Still, its asset efficiency dipped in the last two years resulting in decreased productivity, increased operating costs, and lower return on investment.

Author Calculations

Author Calculations

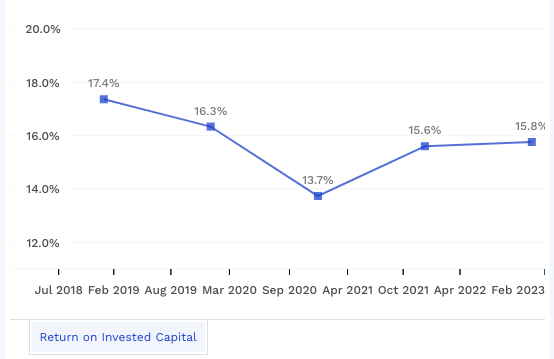

The company’s ROIC has dipped in the last five years but has improved in the last two years from a low of 13.7% in 2020 to 15.8% in 2022, implying that its cost optimization initiatives have added value.

The combination of low revenue growth, low margins and lower ROIC indicate the company faced structural issues due to poor leadership. Further, higher attrition during these years implies that the employees were unsatisfied with the management.

Seeking Alpha

Seeking Alpha

The above factors impacted the company’s share price, with the share price giving a negative 15% return against a 53.3% return in the S&P 500 index in the last five years.

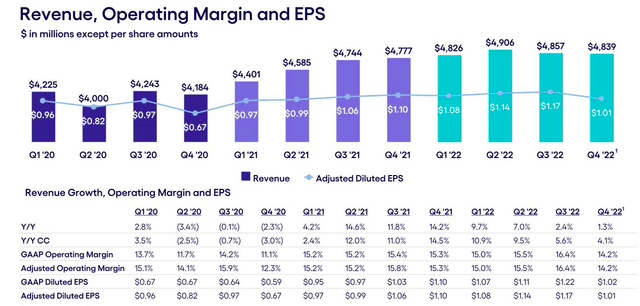

The company released its full-year 2022 results on February 2nd 2023, and closed the year with $19.4 billion in revenues, growing 5% year-over-year and 7.5% in constant currency. In 2022, the company generated $2.6 billion in operating cash flows and $2.2 billion in free cash flows and returned $2 billion to shareholders through dividends and share repurchases. In Q4 2022, the company completed two acquisitions: Austin CSI and Utegration, for a total purchase price of approximately $370 million and announced the acquisitions of Mobica and the professional services and management practices of OneSource Virtual.

According to Jan Siegmund, CFO of Cognizant,

These acquisitions are expected to improve our digital revenue mix, and enhance our consulting capabilities. Our capital allocation framework remains unchanged. Over the longer term, we continue to expect to deploy a balanced capital allocation policy, returning to an aggregate of approximately 50% of free cash flow to shareholders in the form of dividends and share repurchases and allocating the remaining 50% to inorganic investments.

Commenting on 2022 results, Ravi Kumar S, Chief Executive Officer of Cognizant, said:

The trust and longevity that define Cognizant’s strategic partnerships with global clients provide exciting opportunities to strengthen and grow these relationships as we expand our portfolio of digital services. As I continue to listen and learn, I have been deeply impressed with our associates’ knowledge, skills, and motivation. They are dedicated to helping our clients succeed and are determined to compete and win to expand our global leadership in technology services. My immediate focus is on creating the conditions for our associates to excel and ensuring that all 355,000 operate with a growth mindset.

Cognizant Investor Relations

Cognizant Investor Relations

During the fourth quarter of 2022, the company recorded a $59 million impairment of capitalized costs related to a sizeable volume-based contract with a Health Sciences customer due to the company’s expectations of lower volumes. The impairment negatively impacted the company’s operating margin by 30 basis points.

Cognizant Investor relations

Cognizant Investor relations

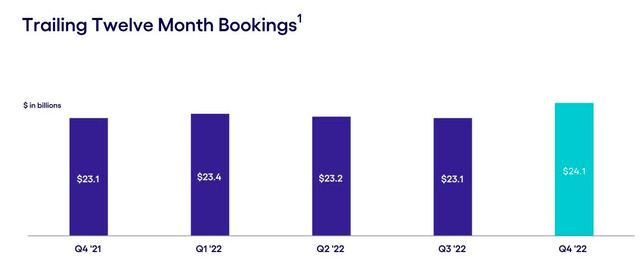

The company’s full-year booking grew 4% to $24.1 billion in 2022, representing a book-to-bill of 1.2x that indicates that the company is receiving more new orders than it is billing for, which suggests that it has a healthy backlog of orders and that it is likely to see revenue growth in the future. Further, in December 2022, the company signed a 10-year $1 billion services agreement with CoreLogic.

Cognizant Investor relations

Cognizant Investor relations

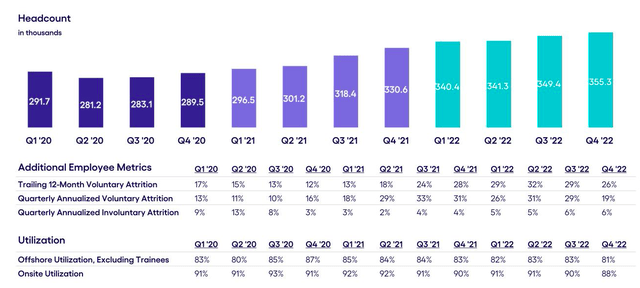

The company’s total headcount at the end of 2022 was 355,300, adding 24,700 employees in 2022. However, the company reported a voluntary attrition of 26% in 2022 against 28% in 2021.

According to Jan Siegmund, Chief Financial Officer,

We exited the year with a meaningful improvement in voluntary attrition, which will help us focus more on improving our commercial momentum. We also continued to execute our balanced capital allocation framework, returning nearly $2 billion to shareholders through dividends and share repurchases in 2022 and announcing four acquisitions in the last three months alone.

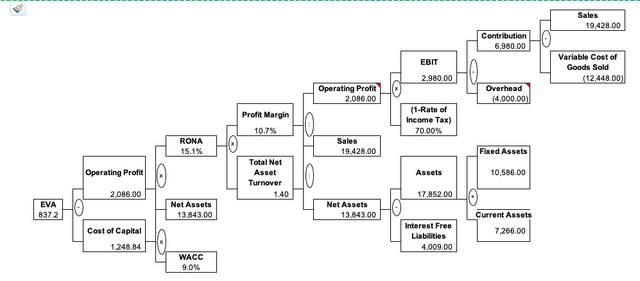

Author Calculations

Author Calculations

To understand the true economic profit, I arrived at the $837.2 million as EVA (Economic Value Added) for Cognizant in 2022, implying that the company is creating value for its shareholders.

In January 2023, the company named Ravi Kumar S as CEO and board member, succeeding Brian Humphries in both roles.

According to Cognizant,

Ravi Kumar has over 20 years of experience in the technology consulting space, incubating new practice lines, driving large transformational programs, and developing new business models across industry segments. Based in New York City, Kumar served as President at Infosys until October 2022. In this role, he led the Infosys Global Services Organization across all global industry segments, driving digital transformation services, consulting services, technology services, engineering services, data & analytics, cloud and infrastructure, and enterprise package applications service lines.

As the new CEO, Ravi Kumar’s focus areas for Cognizant are making it an employer of choice in the IT services industry, strengthening its ability to win large deals, and enhancing its operating efficiency. Thus, Ravi Kumar wants to address the areas where Cognizant has performed poorly in the last five years.

Despite the positive euphemism of leadership change, the turnaround at Cognizant is not simple and cannot be achieved overnight, given its size. When Brian Humphries joined Cognizant, it was also under repair mode, but the former CEO could not turn around the company. Under Brian’s leadership, the company underwent a prolonged reorganization phase and suffered from high attrition, thus eventually losing market share to Infosys and other Indian IT services firms. Thus, the priority for the new leadership team at Cognizant is to arrest the market share losses. Further, due to the slowdown in developed markets, the growth rates of IT companies are already moderating, thus putting more pressure on Cognizant to grow more than the industry. Thus, it is difficult for Cognizant to grow at a higher rate when the overall sector is slowing. As the new CEO is following a tried and tested playbook of filling the gaps in service capabilities and beefing up the sales and deals teams, it remains to be seen whether the company will succeed in winning large deals.

Before I arrive at the intrinsic value of Cognizant using the Discounted Cash Flow approach, I analyze the current macro-environment of the IT services sector, followed by identifying competitors of Cognizant and benchmarking them against Cognizant in different metrics.

As the global economy is witnessing a slowdown, spending is reduced for sizeable digital transformation engagements. However, enterprises are spending on cost-takeout initiatives, and to reduce spend across multiple vendors, they are focusing on vendor consolidation.

According to Ravi Kumar, CEO of Cognizant,

The industry is at lower levels of digital maturity, and health care, life sciences, and manufacturing are stepping up their tech intensity. While those that are more digitally mature, like financial services, retail and communications, are staying invested in digitizing the landscapes. We also interestingly see workplaces rapidly adapting digital technologies as employees get comfortable continuously toggling between hybrid and physical workplaces. Today, every industry is a tech industry. Technology will be deeply embedded in the core of every business, every product and every service. Therefore, the use of deep software engineering capabilities to transform the core of businesses will be a big player for tech services firms like Cognizant. So too will be the market opportunity that comes from born-digital companies that outsource the technology core and operations.

Enterprises will spend a big part of their IT budgets on Cloud services, 5G and IoT. However, in the current challenging macro-environment, investments in digital transformation have taken a back seat as clients focus more on cost reductions. Thus, IT services companies that can deliver a large part of work from cheaper locations like India, use automation to streamline existing processes, improve productivity, and execute significant cost savings to their customers are better placed in the next two years.

For comparables valuation, I identify the following companies that are competitors to Cognizant.

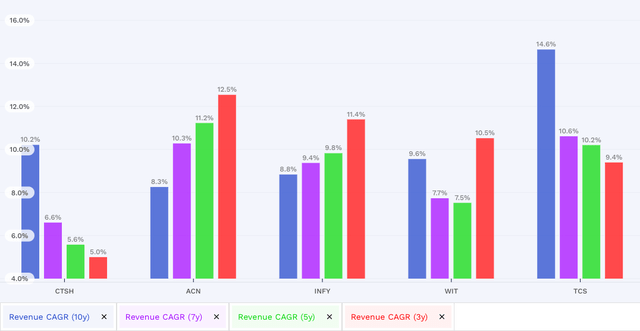

Author Calculations

Author Calculations

In the last five years, Cognizant has lagged behind its competitors. As a result, despite many acquisitions, the company could not win large deals and lost existing customers to the competition. In the last three years, Cognizant grew only at 5% CAGR against its competitor, which grew at a double-digit growth rate. Fearing this slowdown would continue, the board had no alternative but to bring in a new leader from outside to resurrect the company.

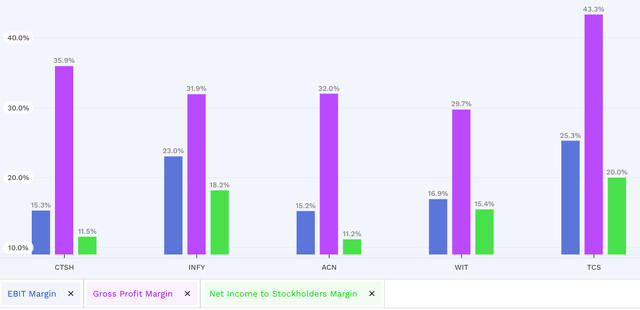

Author Calculations

Author Calculations

When I compare Cognizant’s EBIT margin against its competitors, it fares below its Indian peers but is at par with Accenture. While a large part of Cognizant’s workforce is in India, the company must improve its employee engagement in India to improve its margin further. If the company can achieve that, there is a good chance for the company to boost its EBIT margin to 17% in future, improving the value.

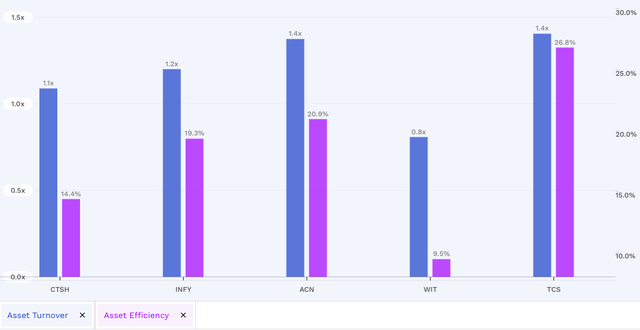

Author Calculations

Author Calculations

Further, when looking at Cognizant’s asset turnover and asset efficiency against its competitors, Cognizant’s asset efficiency lags behind others except for Wipro. However, with the new CEO in place and his three-pronged approach to increasing value, Cognizant has the potential to improve its asset efficiency, resulting in improved profitability and return on invested capital.

Author Calculations

Author Calculations

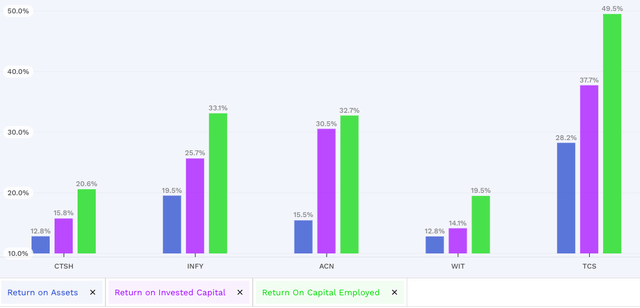

Cognizant has lagged behind its peers, except Wipro, in generating excess shareholder returns. Its ROIC, ROCE and ROA are lower than Accenture, Infosys and TCS, which indicates that the company is not generating as much profit as it could be given its level of investment or assets. However, with the newer management in place and the CEO’s focus on improving operational efficiency, there is a scope for improvement in ROIC, ROA and ROCE metrics.

Author Calculations

Author Calculations

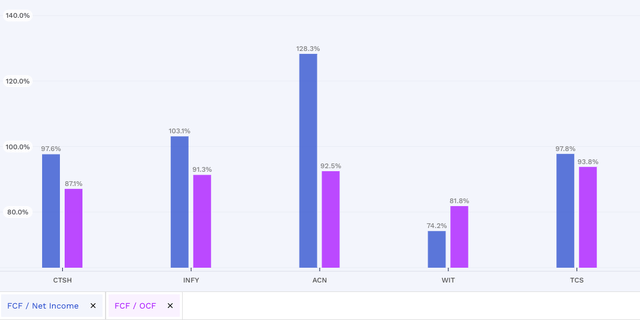

When I benchmark Cognizant against its peers to compare the amount of cash it generates to the amount of net income it earns, its FCF/NI at 97.6% is good, indicating that the company generates a substantial amount of free cash flow relative to its net income, which is a positive sign for investors. The company also has a good FCF/OCF ratio, indicating its strong ability to invest in growth opportunities or return cash to shareholders.

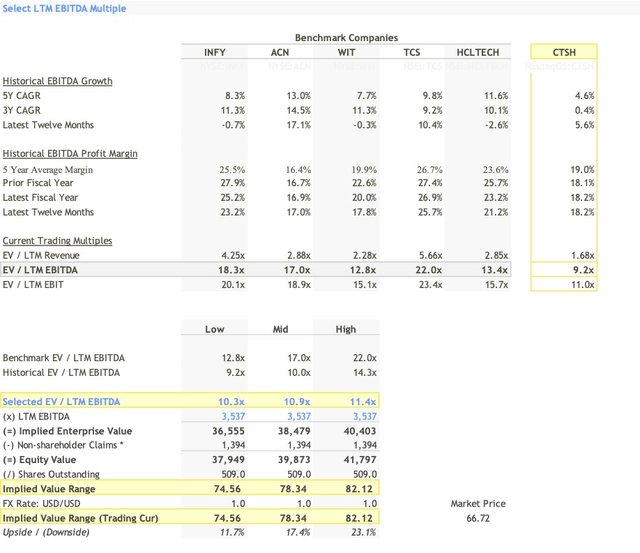

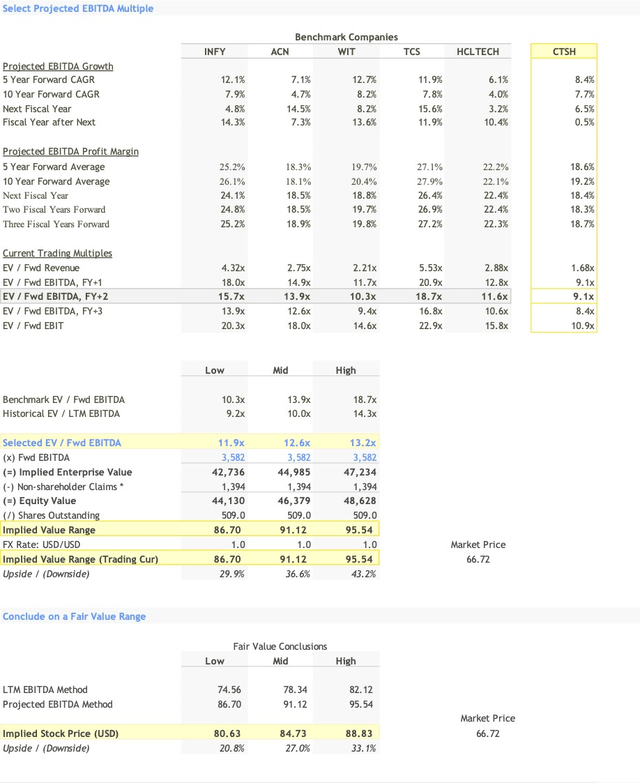

I do comparables valuations using EV/EBITDA multiple to determine the fair value of Cognizant.

Author Calculations

Author Calculations

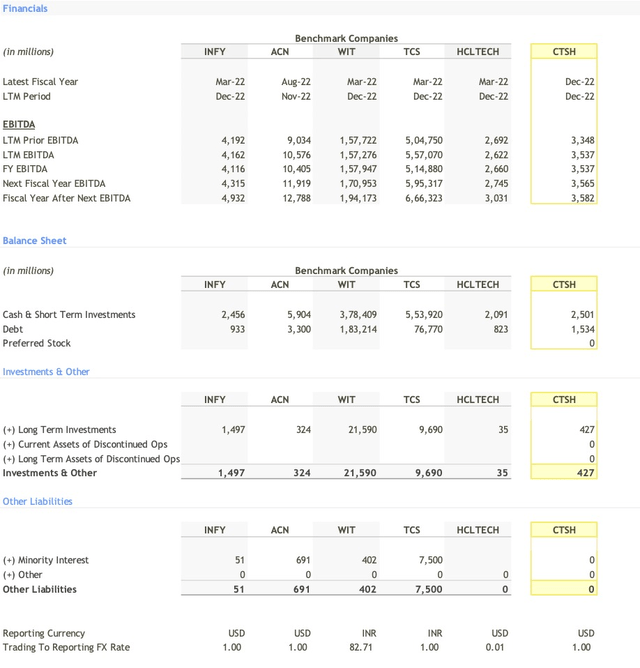

First, I compare the EBITDA of Cognizant against its competitors from its income statement. Then, I look at the company’s cash reserves and investments against its competitors in the balance sheet.

Author Calculations

Author Calculations

From the financials, I calculate the company’s current LTM EV/EBITDA. Then, I assume that Cognizant’s multiple will expand towards its competitors from 9.2x to 10.9x to arrive at the implied price of $78 per share, giving a 17% upside to the current price.

Author Calculations

Author Calculations

In addition to the LTM EBITDA, I also arrived at the projected EBITDA assuming that Cognizant’s EBITDA will grow 8.4% CAGR in the next five years and 7.7% in the next ten years. Then, using the industry EV/EBITDA multiple of 12.9x for Cognizant, I arrive at the fair value of Cognizant at $91 per share, giving it a 36% upside against the current price. Finally, I averaged the fair value obtained from LTM EBITDA and the Projected EBITDA approach to arrive at $84 per share, giving a 27% upside against the current price.

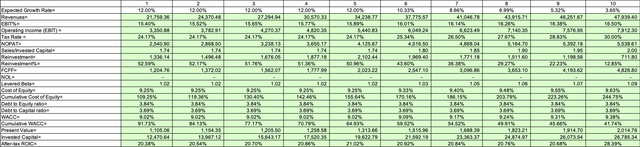

I also value Cognizant using the DCF approach by assuming the following value drivers:

Cognizant will grow 12% for the next five years and 8.2% for the next ten years. The company has strong capabilities in Digital transformation and can grow at this rate with its organic and inorganic pursuits. The company was named a technology leader across industries in 17 analyst reports in Q4 2022. Though the company has given a guidance of $4.71 billion to $4.76 billion in revenues for Q1 2023, representing a year-over-year decline of minus 2.5% to minus 1.5%, I expect the growth to rebound in the remaining part of the year. For instance, Orica selected Cognizant to implement a digital platform to monitor and forecast emissions in real-time and help develop its new ESG data strategy, reporting and governance model. As ESG is a growing market because enterprises are looking to reduce their carbon footprint, Cognizant’s ability to win deals in this segment augurs well for its future growth.

Cognizant’s EBIT margin will improve from 15.3% to 16.5% in the next ten years by reducing attrition, reducing sub-contractors usage, winning large contracts, and moving more work to India. Further, the company’s strong capabilities give it a pricing momentum that can help expand its margin.

Cognizant’s Sales to Invested Capital will improve from 1.74 to 2 in the next ten years as the company improves its productivity by winning high-volume deals and improving operating efficiency.

For my DCF model, I assume the 10-year US treasury bond rate of 3.65% is the risk-free rate.

At the equity risk premium of 5.5%, a levered beta of 1.02, the cost of equity is 9.25%.

The company has $1.5 billion in debt, giving it a debt-to-capital ratio of 3.69%. At 3.7% after-tax cost of debt, I arrive at the weighted average cost of capital for Cognizant at 9.1%.

Author Calculations

Author Calculations

I arrive at the Enterprise value of $79.6 per share.

Adding cash of $2.5 billion and subtracting debt of $1.53 billion, I derive the equity value of Cognizant at $41.9 billion/ $82.3 per share. Thus, Cognizant is undervalued by 21% at the current price.

I conclude my analysis by stating that Cognizant’s fair value is between $82 to $85 per share, and the growth will rebound with the change in leadership.

For Cognizant to rebound, it can take a leaf out of Infosys’ turnaround in the last five years. Infosys was in a similar position to Cognizant, where the company suffered from peak attrition levels, departures of senior personnel, leadership changes, leadership turmoil, and market share losses. Still, they turned it around after Salil Parekh became the CEO. As part of Infy’s leadership team, Ravi Kumar was vital in this turnaround. Therefore, I am bullish on Cognizant’s turnaround and am willing to give the new management a grace period of about six to 12 months to let them operate and show positive signs of recovery.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.